Friday, February 29, 2008

Fridays Thoughts 2/29/2008

I will do some posting over the weekend. The wife wants to have a "Date Night" which it has been a while for us. Bottom line is I will not be posting tonight. Any way my day sucked and I lost about $100 overall.

Friday Morning Thoughts 2/29/2008

I hate it when I do not feel right in the morning. I still do not feel as good as I should but I do feel a lot better than yesterday. The market is so screwed up right now my stocks I want to short are all down.

-

The dollar is still getting hit by the Yen and Swiss Franc but is having a massive rall against the Aussie.

-

I hate ABK. It is getting saved - market goes crazy. It is not going to get saved - market dies. Not Fun.

-

The dollar is still getting hit by the Yen and Swiss Franc but is having a massive rall against the Aussie.

-

I hate ABK. It is getting saved - market goes crazy. It is not going to get saved - market dies. Not Fun.

Thursday, February 28, 2008

Thursday Trade Review 2/28/2008

I suck. I did not feel well today. I felt like I had the chills. I placed a couple of stupid orders it the market. I recommended stocks to my friends that were great trades but did I take them - no. I also place an order in thinking it was a limit order - instead it was a stop buy. I bought a lot higher than I expected and screwed myself on the trade. I had a buy stop for AAPL over 130. I got filled but slipped 16 cents. I saw that my P/L for the trade was negative. WTF I asked? So with out checking why, I just sold the shares and made a big 8 dollars thinking I must have screwed something up. I need to calm down and take a deep breath and look at what happened. AAPL then run 2 dollars with out me.

-

The numbers:

Stocks: gross + 51 net +29 shares 4400

Stock Futures: gross -50 net -55 contracts 2

Other Futures: none

Forex: none

-

The numbers:

Stocks: gross + 51 net +29 shares 4400

Stock Futures: gross -50 net -55 contracts 2

Other Futures: none

Forex: none

Currency Markets 2/28/2008

I have not said anything recently about the Currency Markets. The market had become so choppy; I got sick of fighting them. A course like so many other times, you give up on a market and it becomes trendy again and easier to trade.

I have not said anything recently about the Currency Markets. The market had become so choppy; I got sick of fighting them. A course like so many other times, you give up on a market and it becomes trendy again and easier to trade.-

Only the GBP/USD looks like it may stay choppy. All the others have taken off with nice long moves. Some of the moves are 100s of Pips - see EUR/USD and AUD/USD. I was long the AUD/USD but allowed myself to be stopped out way to early and the EUR/USD I should have done a stop and reverse.

Only the GBP/USD looks like it may stay choppy. All the others have taken off with nice long moves. Some of the moves are 100s of Pips - see EUR/USD and AUD/USD. I was long the AUD/USD but allowed myself to be stopped out way to early and the EUR/USD I should have done a stop and reverse.

-

Even the other 3 are moving well - USD/JPY, USD/CHF and USD/CAD. Now the problem is where to catch a ride on the train.

-

The scary point of all of these markets is the US Dollar is getting hit badly. Something I do not think is good long term.

The scary point of all of these markets is the US Dollar is getting hit badly. Something I do not think is good long term.

Wednesday, February 27, 2008

Wednesday Trade Review 2/27/2008

I feel I am slowly getting better at picking my winners. I am also getting slowly better at holding on to the trades to let them work. Unfortunately, I am not letting my winners run. Three of my best trades today where I gained 13, 23 and 19 cents went an additional 55, 45 and 75 cents. In other words, I could double or triple my profit. On top of that my size should have been five times larger in the first trade and doubled the other two. You can do the math.

-

Anyway, I made $119 on stocks but had two bone head trades in futures for a loss of $115.

-

I had dinner with a friend and need to do a bunch of other things - no charts.

-

The numbers:

Stocks: gross +135 net +119 shares 2000

Stock Futures: gross -100 net -115 contracts 6

Other Futures: none

Forex: none

-

Anyway, I made $119 on stocks but had two bone head trades in futures for a loss of $115.

-

I had dinner with a friend and need to do a bunch of other things - no charts.

-

The numbers:

Stocks: gross +135 net +119 shares 2000

Stock Futures: gross -100 net -115 contracts 6

Other Futures: none

Forex: none

Tuesday, February 26, 2008

Tuesday Trade Review 2/26/2008

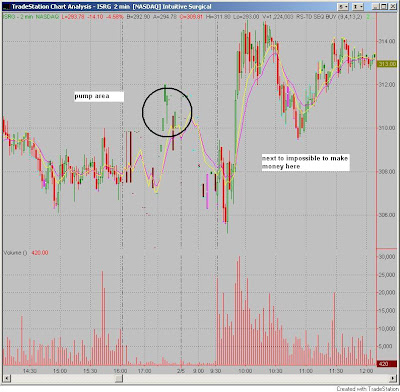

Here are some charts of my trades today. I made more futures trades yesterday then I have for a long time yesterday, today I made more stock trades than I have for a long time.

Here are some charts of my trades today. I made more futures trades yesterday then I have for a long time yesterday, today I made more stock trades than I have for a long time.-

I am very good at cutting my losses. My prior big losing months, I have always have one killer trade or two destorying me. Now I need to learn to sit on my hands and alllow my trades to work.

-

The numbers:

Stocks: gross +140 net +114 shares 4200

Stock Futures: none

Other Futures: none

Forex: none

Tuesday Big Mouth Stocks 2/26/2008

The Big Mouth is back after being on vacation. Either of these would have worked using any method. My idea is the short them with in the first 15 minutes. I did short XTO and after it went no where, I got out with a 15 cent gain. If a big mouth stock does not go down, I start looking for places to go long. Look at my trade review post for that part.

The Big Mouth is back after being on vacation. Either of these would have worked using any method. My idea is the short them with in the first 15 minutes. I did short XTO and after it went no where, I got out with a 15 cent gain. If a big mouth stock does not go down, I start looking for places to go long. Look at my trade review post for that part.Tuesday Mid Day Thoughts 2/26/2008

I hate Taxes and Teenagers.

-

I have always done my own taxes. The last couple of years I have used Turbo Tax. I think it is a good and simply product to use. Last year I bought a very simple product to slice and dice my broker statements to produce my Sched D. Last year it worked great. I had about 700 lines of transactions meaning if I bought and sold in pieces of 1000 shares or AKS it might be broken down into pieces of 100 or 200 shares. The software would put it back together as one transaction so the result was 175 trades. This whole process took me about 2 hours.

-

This year I had 2200 transactions. The software would not work. I called them and they said they stopped supporting the product. I played with it and played. After my fourth attempt and about 20 hours, I finally got it to work. Only problem it gave me a bunch of errors from the way IB does Currency transactions. Once I got a mock Sched D, I compared it to the one that you can get from IB. Over a million dollars in total transaction differences between the two reports. I wanted to cry. A couple of days later, I find a note on IBs website that they needed to reprocess their Sched Ds. The difference is now one penny.

-

Now I produce the file to go into Turbo Tax. I was expecting the 2200 transactions to melt down to 300 or 400 - instead 775. Turbo Tax was not happy. I had to go through something like 60 transaction to make sure they were not dups. Also the stock I transferred into my IB account was all screwed up. After many more hours of work and having to add in the Currency transaction by hand it was finally done. I had never gone through such Tax Hell before.

-

Now teenagers - last year I told you guys how a 13 year old nearly killing me in two matches. I won the first match 2 games to 1 but lost the second 1 game to 2. Last night a 15 year old, did not only beat me but only took two games to do 15-11 and 15-5. He was not even tired. It sucks getting old.

-

I have always done my own taxes. The last couple of years I have used Turbo Tax. I think it is a good and simply product to use. Last year I bought a very simple product to slice and dice my broker statements to produce my Sched D. Last year it worked great. I had about 700 lines of transactions meaning if I bought and sold in pieces of 1000 shares or AKS it might be broken down into pieces of 100 or 200 shares. The software would put it back together as one transaction so the result was 175 trades. This whole process took me about 2 hours.

-

This year I had 2200 transactions. The software would not work. I called them and they said they stopped supporting the product. I played with it and played. After my fourth attempt and about 20 hours, I finally got it to work. Only problem it gave me a bunch of errors from the way IB does Currency transactions. Once I got a mock Sched D, I compared it to the one that you can get from IB. Over a million dollars in total transaction differences between the two reports. I wanted to cry. A couple of days later, I find a note on IBs website that they needed to reprocess their Sched Ds. The difference is now one penny.

-

Now I produce the file to go into Turbo Tax. I was expecting the 2200 transactions to melt down to 300 or 400 - instead 775. Turbo Tax was not happy. I had to go through something like 60 transaction to make sure they were not dups. Also the stock I transferred into my IB account was all screwed up. After many more hours of work and having to add in the Currency transaction by hand it was finally done. I had never gone through such Tax Hell before.

-

Now teenagers - last year I told you guys how a 13 year old nearly killing me in two matches. I won the first match 2 games to 1 but lost the second 1 game to 2. Last night a 15 year old, did not only beat me but only took two games to do 15-11 and 15-5. He was not even tired. It sucks getting old.

Monday, February 25, 2008

Monday Trade Review 2/25/2008

Crazy day with that rally out of left field. I had shorted the market seconds before and I had not put in my stop loss order yet. Very painful. I was putting in an 8 point reverse stop but as I typed it in, the market had exploded so instead of taking a small short loss and making tons of money on the long side, I was in pain. It took me a few second to get the order in to get me out. Not funny.

-

I then became crazy and started firing off trades left and right with very little reason. At my low point, I was down about $400 and ended off only $150 when the dust settled. I had been down about $175 after my screwed up stop.

-

All of this happened after getting a late start to the day because I had a doctor's appointment. I did not start trading until nearly noon.

-

I am looking forward to the fact the Big Mouth is back in town and will provide stock picks for me.

-

The numbers:

Stocks: gross +3 net -12, shares 3000

Stock Futures: gross -100 net -135 contracts 16 (a high for me I think)

Other Futures: none

Forex: none

-

I then became crazy and started firing off trades left and right with very little reason. At my low point, I was down about $400 and ended off only $150 when the dust settled. I had been down about $175 after my screwed up stop.

-

All of this happened after getting a late start to the day because I had a doctor's appointment. I did not start trading until nearly noon.

-

I am looking forward to the fact the Big Mouth is back in town and will provide stock picks for me.

-

The numbers:

Stocks: gross +3 net -12, shares 3000

Stock Futures: gross -100 net -135 contracts 16 (a high for me I think)

Other Futures: none

Forex: none

Friday, February 22, 2008

Friday Trade Review 2/22/2008

This crazy market is driving me nuts. I was scalping the YM market for a few here and a few points there and then all hell broke lose. I am really pissed at myself because I found I could not react fast enough. Over at Dehtrader's place, a trader stated a minutes before hand CNBC was going to talk about ABK making a deal. It did not sink into my brain that it would be mean anything important but bingo, the market explodes.

-

As soon as things started, I should have been piling into XLF and YMs but I just sat there with my thumb up my ass like an idiot. By the time I did start to react, the market just had enough back and forward to keep me out. Pisser.

-

The numbers:

Stocks: gross -15, net -19 shares 600

Stock Futures: gross +130 net +95 contracts 14

Other Futures: none

Forex: none

-

As soon as things started, I should have been piling into XLF and YMs but I just sat there with my thumb up my ass like an idiot. By the time I did start to react, the market just had enough back and forward to keep me out. Pisser.

-

The numbers:

Stocks: gross -15, net -19 shares 600

Stock Futures: gross +130 net +95 contracts 14

Other Futures: none

Forex: none

Thursday, February 21, 2008

Currency Markets 2/21/2008

I am going to scratch the USD/CAD trade at even. I need to spend some time looking at the charts and figure things out.

Thursday Trade Review 2/21/2008

Made only a couple of trades today. I caught a good short on the chart above and I would have done it again (see post below). I had one futures trade too and earned a couple of happy meals.

Made only a couple of trades today. I caught a good short on the chart above and I would have done it again (see post below). I had one futures trade too and earned a couple of happy meals.-

The numbers:

Stocks: gross +69 net + 63 shares 1200

Stocks Futures: gross +25 net +20 contracts 2

Other Futures: none

Forex: none

I need to Whine 2/21/2008

Above are the charts of a trade I tried doing. I had a sell stop of AKS at 49.29. The stock was just about to break 49.30 when I placed the order in. There was a big buyer at 49.31. I assumed another would show at 49.30 so to short under 49.30. At the same time I placed the order, the stock broke 49.30 and I thought I should be filled right away. No I was not. Then the stock popped up to 49.34 and dropped back down and then I thought I should be filled. No I was not. I canceled figuring something was wrong in the order or my platform or what ever. Then the stock fell hard.

Above are the charts of a trade I tried doing. I had a sell stop of AKS at 49.29. The stock was just about to break 49.30 when I placed the order in. There was a big buyer at 49.31. I assumed another would show at 49.30 so to short under 49.30. At the same time I placed the order, the stock broke 49.30 and I thought I should be filled right away. No I was not. Then the stock popped up to 49.34 and dropped back down and then I thought I should be filled. No I was not. I canceled figuring something was wrong in the order or my platform or what ever. Then the stock fell hard.-

I called my broker to find out why no fill. They basically said I was seeing things and my order was only in for 15 seconds. I really felt my order was in for at least a minutes and could have been easily filled. The broker did not move at all and said it must have been a problem with my computer. Fun.

Wednesday, February 20, 2008

Wednesday Trade Review 2/20/2008

It is such a relief to trade feeling normal. Between needing to adjust medication and then being sick, I have really felt screwed up. I do not know why the fog lifted today. The body is a strange thing.

-

I wish it did more for my trading today. I only made 4 trades today. The Fed release made a mess of the day for me. In all four trades, I freaked out of them. None of them would have gone more than $25 against me before moving in my favor. The one stock I let run, I cut after moving 27 cents. I had been up 40 cents then only up 20 before I cut it off at 27 cents. I moved another 50 cents before having its first major correction. If I sat on my hands, I could have been up over $1000 today.

-

I got to learn not to freak out. I need to turn my frustration into action.

-

The numbers:

Stocks: gross +89 nets +76 shares 2600

Stock Futures: none

Other Futures: none

Forex: none

Wednesday Morning Thoughts 2/20/2008

It looks like I will be right on my USD/CAD after all - funny. I did not paper trader that well. The dollar is kicking ass right now. It is the first time all the majors are trading together.

-

The stock market is down hard right now trying to find a bottom between 12250 and 12275. There are a lot of triangle formations on the indexes and we could break them all to the downside. The street was not happy with STP earnings. This could mean another leg down for the Solars. If the overall market breaks, the Ags, Shippers and Steels could be good places for shorts.

-

Oil is amazing. It is scary. If this was been one big sideways formation then we could see $130 Oil easily.

-

For a lot of reasons, both mental and health wise - this is the first time I am beginning to feel normal after about 5 weeks. I just hope I can turn it into some good trades.

-

The stock market is down hard right now trying to find a bottom between 12250 and 12275. There are a lot of triangle formations on the indexes and we could break them all to the downside. The street was not happy with STP earnings. This could mean another leg down for the Solars. If the overall market breaks, the Ags, Shippers and Steels could be good places for shorts.

-

Oil is amazing. It is scary. If this was been one big sideways formation then we could see $130 Oil easily.

-

For a lot of reasons, both mental and health wise - this is the first time I am beginning to feel normal after about 5 weeks. I just hope I can turn it into some good trades.

Tuesday, February 19, 2008

Tuesday Trade Review 2/20/2008

Sorry for the late post but it was the wife's birthday today. I only got trade for a short time in the morning. I really got myself screwed up on a Big Mouth stock and made one futures trade.

-

The numbers:

Stocks: gross -77 net -87 shares 1280

Stock Futures: gross +25 net +20 contracts 2

Other Futures: none

Forex: none

-

The numbers:

Stocks: gross -77 net -87 shares 1280

Stock Futures: gross +25 net +20 contracts 2

Other Futures: none

Forex: none

Sunday, February 17, 2008

Currency Markets 2/15/2008

Very frustrating markets are here. The currencies have become super choppy. I am still just trying to paper trade this system wondering if I have the guts to follow it and I a course I come into a period that is a mess like this. If I had started this last summer, the first six months of this would have been so much easier.

Very frustrating markets are here. The currencies have become super choppy. I am still just trying to paper trade this system wondering if I have the guts to follow it and I a course I come into a period that is a mess like this. If I had started this last summer, the first six months of this would have been so much easier.-

Right now I am only officially long the USD/CAD and sitting at a loss. I should be long the EUR/USD, AUD/USD (bad stop), and USD/JPY. The GBP/USD and USD/CHF are close calls.

Saturday, February 16, 2008

Friday Trade Review 2/15/2008

I am sick about complaining I am sick.

-

The numbers:

Stocks: gross -99 net -113 shares 2800

Stock Futures: none

Other Futures: none

Forex: none

-

The numbers:

Stocks: gross -99 net -113 shares 2800

Stock Futures: none

Other Futures: none

Forex: none

Thursday, February 14, 2008

Thursday Trade Review 2/14/2008

Today I asked my wife if there was anything she wanted for Valentines Day (we celebrate on the Weekend to avoid the crowds). Her response was "All I want is for you to go to the doctor and get your cough checked out". So I did like a good boy.

-

I do not know why I even try to trade. So many people are having many problems with this market and coughing your lungs out does not help.

-

The numbers:

Stocks: gross -20 net -26 shares 1000

Stock Futures: none

Other Futures: none

Forex: none

-

I do not know why I even try to trade. So many people are having many problems with this market and coughing your lungs out does not help.

-

The numbers:

Stocks: gross -20 net -26 shares 1000

Stock Futures: none

Other Futures: none

Forex: none

Currency Markets 2/14/2008

Stopped out of the EUR/USD. Getting killed on the USD/CAD. Markets are very choppy. I do not know if it is worth trying to deal with the choppiness.

Wednesday, February 13, 2008

Wednesday Trade Review 2/13/2008

Still sick. This how my day goes - watch market for an hour, cough my brains out for an hour, sleep for an hour - repeat.

-

I caught one of the Big Mouth Stocks nearly at its peak but then it fell too quickly to get an size on. Other than that, I did not see much during the short time I could watch the market.

-

The numbers:

Stocks: gross +84 net +75 shares 1800

Stock Futures: none

Other Futures: none

Forex: none

-

I caught one of the Big Mouth Stocks nearly at its peak but then it fell too quickly to get an size on. Other than that, I did not see much during the short time I could watch the market.

-

The numbers:

Stocks: gross +84 net +75 shares 1800

Stock Futures: none

Other Futures: none

Forex: none

Tuesday, February 12, 2008

Tuesday Trade Review 2/12/2008

I am still sick. I should not be trading except I cough so much, I can't sleep and I am sick of watching Soaps. It sounds like a lot of traders had problems with the market today.

-

The numbers:

Stocks: gross -88 net -95 shares 1200

Stock Futures: none

Other Futures: none

Forex: none

-

The numbers:

Stocks: gross -88 net -95 shares 1200

Stock Futures: none

Other Futures: none

Forex: none

Monday, February 11, 2008

Monday Trade Review 2/11/2008

I am sick today - coughing my lungs up. I made a couple of trades but slept for a good part of the trading day.

-

I screwed up a big mouth play and the two others trades were scratchs.

-

The numbers:

Stocks: gross -70 net -77 shares 1000

Stock Futures: none

Other Futures: none

Forex: none

-

I screwed up a big mouth play and the two others trades were scratchs.

-

The numbers:

Stocks: gross -70 net -77 shares 1000

Stock Futures: none

Other Futures: none

Forex: none

Sunday, February 10, 2008

Friday, February 8, 2008

Friday Trade Review 2/8/2008

Crappy day. Not feeling well. Five trades, five small losses.

-

The numbers:

Stocks: gross -66 net -77 shares 1800

Stock Futures: none

Other Futures: none

Forex: none

-

I will post the Big Mouth stocks later along with my monthly review and currencies this weekend.

-

The numbers:

Stocks: gross -66 net -77 shares 1800

Stock Futures: none

Other Futures: none

Forex: none

-

I will post the Big Mouth stocks later along with my monthly review and currencies this weekend.

Thursday, February 7, 2008

Thursday Trade Review 2/7/2008

I had an okay day today. I made a small amount off of PBR (Big Mouth Stock). I should have made more but I was busy with many things this morning. I caught the pop in Ag Stock in the afternoon but again I only had 200 shares and caught 60 cents of a 3 dollar move. I got to sit on my hands. I have cut short so many good trades that could have been so much better. I need to push the size still.

-

The numbers:

Stocks: gross +157 net +149 shares 1200

Stock Futures: none

Other Futures: none

Forex: none

-

The numbers:

Stocks: gross +157 net +149 shares 1200

Stock Futures: none

Other Futures: none

Forex: none

Currency Market Update 2/7/2008

Sell your long AUD/USD at 0.8895 and remain flat (+95 pips). Sell your short USD/CAD at 1.010 (+80 pips) and go long. Move the stop for the short EUR/USD to 1.4675. All the currency markets are very choppy right now. You must protect profits.

Wednesday, February 6, 2008

Wednesday Trade Review 2/6/2008

Dug a hole this morning and filled it in this afternoon.

-

The numbers:

Stocks: gross +61 net + 39 shares 3400

Stock Futures: none

Other Futures: none

Forex: none

-

The numbers:

Stocks: gross +61 net + 39 shares 3400

Stock Futures: none

Other Futures: none

Forex: none

Tuesday, February 5, 2008

Tuesday Trade Review 2/5/2008

Did not trade well. I am not feeling well. I took a couple of naps today.

-

The numbers:

Stocks: gross -18 net -30 shares 1800

Stock Futures: none

Other Futures: none

Forex: none

-

The numbers:

Stocks: gross -18 net -30 shares 1800

Stock Futures: none

Other Futures: none

Forex: none

Currency Market Updates 2/5/2008

We were stopped out and reversed on the EUR/USD this morning at 1.4725. We were also stopped on USD/CHF at 1.1000 - no reverse. We are still long the AUD/USD and short USD/CAD. I would short the GBP/USD if it hits 1.9700.

Monday, February 4, 2008

Monday Trade Review 2/4/2008

Today was stupid. I had too many things on my mind not related to trading. Other than one trade at 8 this morning, I did nothing during this boring day.

-

The numbers:

Stocks: gross -30 net -32 shares 400

Stock Futures: none

Other Futures: none

Forex: none

-

The numbers:

Stocks: gross -30 net -32 shares 400

Stock Futures: none

Other Futures: none

Forex: none

Monday Midday Thoughts 2/4/2008

I am tired. If I hear or read one more person has a Super Bowl Hangover I will scream. As with so many others, I got home really late too and I am not functioning well. I missed three really good trades and f-ed another one up. I am not in a good mode. I am also in the process of fighting a BS traffic ticket. I just need to figure out how much the process is going to cost me - PITA.

Sunday, February 3, 2008

Currency Markets 2/3/2008

The Currency Markets look like they are becoming choppy. Tighter stops are needed to protect profits.

The Currency Markets look like they are becoming choppy. Tighter stops are needed to protect profits.-

EUR/USD - It looks like the EUR is having problems breaking thru the 1.49 area and may need to back off one more time. We arre long from 1.4700 with a stop at 1.4725. We will consider reversing when it is hit.

-

AUD/USD - The Aussie is trading a lot better. We are long from 0.8800 and will place the stop 0.8844 for now. We will consider reversing if hit.

-

GBP/USD - I have not done well on the Cable with this bounce. After taking out nearly 1000 pips on the last trade, I have found it hard to get back in. The decline on Friday was massive. We will watch the action for now.

-

USD/CAD - The USD/Loonie has been the easiest of currencies to play recently. We are short from 1.0190 with a stop at 1.0144. I want to make it lower with a reverse stop but will wait a couple of days first.

-

USD/JPY - I am frustrated that I had the stop just a little too close. I think the USD/Yen will bounce around for a while before going in either direction.

-

USD/CHF - We are still nicely short the USD/Swiss Franc from 1.1400 with a stop at 1.1000. The bounce on Friday was very big. Odds are we will get stopped and will consider going long at that time.

Friday, February 1, 2008

Friday Trade Review 2/1/2008

I continue to increase my trade size. I have been a wimp too long with the trades I take. Many of the trades I took at the beginning of January were mainly 100 shares. Most of those trades by the end of January were 200. Now I need to push them even higher. We shall see.

-

I look at my trades today and I took 6 trades. Three of them had good setups. Two, I was a little late to and one was just plain dumb. The dumb one I lost money on. The two I was late with - one made money and the other lost. Of the three good setup, it was a split - one made money, one lost money and the last was a scratch. I need to think more about my entries.

-

I did trade two of the Big Mouth stocks. I wish I had the brain power to trade all 4. RL could have been a monster trade and JCP was good too. You can see them below.

-

The numbers:

Stock: gross -22 net -42 shares traded 3100

Stock Futures: none

Other Futures: none

Forex: none

-

I look at my trades today and I took 6 trades. Three of them had good setups. Two, I was a little late to and one was just plain dumb. The dumb one I lost money on. The two I was late with - one made money and the other lost. Of the three good setup, it was a split - one made money, one lost money and the last was a scratch. I need to think more about my entries.

-

I did trade two of the Big Mouth stocks. I wish I had the brain power to trade all 4. RL could have been a monster trade and JCP was good too. You can see them below.

-

The numbers:

Stock: gross -22 net -42 shares traded 3100

Stock Futures: none

Other Futures: none

Forex: none

Friday Big Mouth Stocks 2/1/2008

The four stocks above are JCP, HOLX, RL, and DIS. There was plenty of Big Mouth Action happening today. I tried watching all 4 but did not get my orders in fast enough. I did catch DIS for a small amount and even caught HOLX for a small gain. I was pissed that I was not fast enough on all of them. My best entry was on HOLX and that provided the smallest opportunity. RL could have been a monster trade.

The four stocks above are JCP, HOLX, RL, and DIS. There was plenty of Big Mouth Action happening today. I tried watching all 4 but did not get my orders in fast enough. I did catch DIS for a small amount and even caught HOLX for a small gain. I was pissed that I was not fast enough on all of them. My best entry was on HOLX and that provided the smallest opportunity. RL could have been a monster trade.

Subscribe to:

Comments (Atom)