I should have made a butt load of money but instead I had my head up in it. I think of 50% pullbacks of the last swing as being a great place to enter. Very simple system. Today, it had 11 chances by my count. Two near misses, eight wins and one loss (last trade). A win I consider is any trade that goes a point in your favor before going two points against you. I only made one of these trades today. Life got in the way on a few of them but I should have taken 4 or 5 more today. I have lost some of my nerve with all the craziness of the Brexit market swings.

Tuesday, June 28, 2016

Sunday, June 12, 2016

good openning ES range trade plus the method to my madness 6/10/2016

Friday was a great example of my trading method. The lines, arrows and circles, I place on the chart as the trading day goes on.

--------------------------------------

My rules are simple:

1) wait for a trend change

2) buy or sell the ES after a pull back to either a chart point or 50% level or both

3) look for stoc to agree - above 50 a buy, below 50 a sell

4) risk 2 points or a break of the most current level

5) profit target one point - if trading multiple contracts take most off a one point and try to allow the rest to be a runner

--------------------------------------

Many times I do not follow the rules to the letter based on market situations but I try.

Sometimes I will try for a runner even thou I am only trading one contract like today.

-------------------------------------

At point 1 on the chart is the first good setup for a short. You can't see it on the chart but the market broke down at about 7:39 but the sideways action between 7:30 and 8:30 plus news at 8:30 did not give much of a good entry. On the break 2091 at 8:42, you could have sold the pullback to 2091 a few bars later but I was looking for a better setup.

At the open, the ES bounced back to 2019 and everything was in perfect alignment. I shorted are 2090.75 and as we began to break hard decided on a runner. I took 9 ticks.

------------------------------------

At point 2, ES had broken down from 2089 and rallied back to that point. A 50% retracement and stoc was still negative.

------------------------------------

At point 3, ES have broken above 2090 a trend change, then had a 50% retracement back 2090 and stoc has still above 50.

------------------------------------

At point 4 it gets a little messier. Was the break below 2091 a trend change or not? I believe it to be so the pullback to 2091, again 50% and stoc still below 50 was a short trad entry.

------------------------------------

At point 5 it gets even messier. With the break below 2087 on a close of a candle, was the bounce plus sideways action around a trend break? I would say no because of it being a down day. You could have played it either way or both.

------------------------------------

Again in the action between 2:30 and 3:00 you could make a case for longs or shorts. We had too much weakness and not enough of a bounce for me to think either way. Now thinking about it after the market is closed, not enough of a bounce would signal a short in my mind seeing I did not mark it as the trading day was going on.

------------------------------------

At point 6, there is another long but that is really hard to take at the close on a Friday.

------------------------------------

Bottom line is my mind is keep your trading rules simple and wait for good setups based on them.

--------------------------------------

My rules are simple:

1) wait for a trend change

2) buy or sell the ES after a pull back to either a chart point or 50% level or both

3) look for stoc to agree - above 50 a buy, below 50 a sell

4) risk 2 points or a break of the most current level

5) profit target one point - if trading multiple contracts take most off a one point and try to allow the rest to be a runner

--------------------------------------

Many times I do not follow the rules to the letter based on market situations but I try.

Sometimes I will try for a runner even thou I am only trading one contract like today.

-------------------------------------

At point 1 on the chart is the first good setup for a short. You can't see it on the chart but the market broke down at about 7:39 but the sideways action between 7:30 and 8:30 plus news at 8:30 did not give much of a good entry. On the break 2091 at 8:42, you could have sold the pullback to 2091 a few bars later but I was looking for a better setup.

At the open, the ES bounced back to 2019 and everything was in perfect alignment. I shorted are 2090.75 and as we began to break hard decided on a runner. I took 9 ticks.

------------------------------------

At point 2, ES had broken down from 2089 and rallied back to that point. A 50% retracement and stoc was still negative.

------------------------------------

At point 3, ES have broken above 2090 a trend change, then had a 50% retracement back 2090 and stoc has still above 50.

------------------------------------

At point 4 it gets a little messier. Was the break below 2091 a trend change or not? I believe it to be so the pullback to 2091, again 50% and stoc still below 50 was a short trad entry.

------------------------------------

At point 5 it gets even messier. With the break below 2087 on a close of a candle, was the bounce plus sideways action around a trend break? I would say no because of it being a down day. You could have played it either way or both.

------------------------------------

Again in the action between 2:30 and 3:00 you could make a case for longs or shorts. We had too much weakness and not enough of a bounce for me to think either way. Now thinking about it after the market is closed, not enough of a bounce would signal a short in my mind seeing I did not mark it as the trading day was going on.

------------------------------------

At point 6, there is another long but that is really hard to take at the close on a Friday.

------------------------------------

Bottom line is my mind is keep your trading rules simple and wait for good setups based on them.

Sunday, May 22, 2016

Good opening ES range trade 5/20/2016

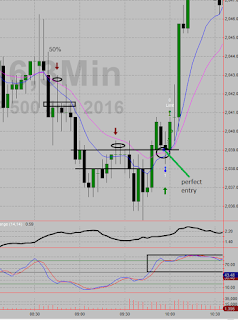

I love it when everything works out perfectly.

------------------------------------------------------

Coming into the opening, the ES was near the top of a 4 point range. I was hoping for a pullback to the middle of the lower part of the range or about two points. When on the opening minute of trading, the ES goes in the opposite way of the current basis, trading against that direction is highly profitable. The stoc was bullish so the basis in my mind was bullish. The market had been going sideways after a good movement up. I wanted to enter around 2043 with the stop below 2042. Usually I take most if not all of the trade off at one point but this looked like a good opportunity to try for the top of the range at 2046. Once the market paused at 2043, I entered at 2043.25 and trailed with a one point stop that got hit at 2046. In hindsight, I could have gotten more if I had just a tick or bigger stop, but I will take the 2 3/4 gain.

--------------------------------------------------------

Moments later the market gave two great entries to buy the pullbacks at 2046.75 and 2046.25. Both I failed at by trying to get filled at 2045.75 which was a 50% pullback. Got to be just a hair more aggressive.

------------------------------------------------------

Coming into the opening, the ES was near the top of a 4 point range. I was hoping for a pullback to the middle of the lower part of the range or about two points. When on the opening minute of trading, the ES goes in the opposite way of the current basis, trading against that direction is highly profitable. The stoc was bullish so the basis in my mind was bullish. The market had been going sideways after a good movement up. I wanted to enter around 2043 with the stop below 2042. Usually I take most if not all of the trade off at one point but this looked like a good opportunity to try for the top of the range at 2046. Once the market paused at 2043, I entered at 2043.25 and trailed with a one point stop that got hit at 2046. In hindsight, I could have gotten more if I had just a tick or bigger stop, but I will take the 2 3/4 gain.

--------------------------------------------------------

Moments later the market gave two great entries to buy the pullbacks at 2046.75 and 2046.25. Both I failed at by trying to get filled at 2045.75 which was a 50% pullback. Got to be just a hair more aggressive.

Monday, May 9, 2016

How I build mental capital - 2016-05-09

I was trying to figure out something clever to post so I came up with this.

---------------------------------

This is a full trading day of the ES-mini. There is 19 arrows on the chart where trades should have been placed based on my rules. Of those 19 trades - the following is a break down:

1) 19 trades - one of them was premarket.

2) Of the 19, I was present at my desk for 12 of the possible trades.

3) Of the remaining 12, I identified 8 of them ahead of time. The other 4 a few ticks too late.

4) Of the remaining 8, I chickened out of two and had unrealistic entry's for another 2.

5) Of the remaining 4, I got filled on 3 and should have been filled on the other.

6) Of the 3 that got filled, all 3 went to target but I chickened out of one before hand.

----------------------------------

Bottom line - I did okay but you might say - DT you could have made a ton of money today.

And yes I could have but I take pride that I watched the market for as long as I did and the fact if I followed my rules to the letter - I would have had 19 winners out of 19 trades. So I need to stick to my trading plan and push myself to take and hold on it more trades.

----------------------------------

I am having more and more days like this.

I just need to - DO IT.

---------------------------------

This is a full trading day of the ES-mini. There is 19 arrows on the chart where trades should have been placed based on my rules. Of those 19 trades - the following is a break down:

1) 19 trades - one of them was premarket.

2) Of the 19, I was present at my desk for 12 of the possible trades.

3) Of the remaining 12, I identified 8 of them ahead of time. The other 4 a few ticks too late.

4) Of the remaining 8, I chickened out of two and had unrealistic entry's for another 2.

5) Of the remaining 4, I got filled on 3 and should have been filled on the other.

6) Of the 3 that got filled, all 3 went to target but I chickened out of one before hand.

----------------------------------

Bottom line - I did okay but you might say - DT you could have made a ton of money today.

And yes I could have but I take pride that I watched the market for as long as I did and the fact if I followed my rules to the letter - I would have had 19 winners out of 19 trades. So I need to stick to my trading plan and push myself to take and hold on it more trades.

----------------------------------

I am having more and more days like this.

I just need to - DO IT.

Wednesday, April 13, 2016

perfect ES trade 4/12/2016

Not much to say on this one. Morning range of 2039 to 2043 was broken. Just before open the market retraced to break down point. Most of the time the first minute of trading is in the wrong direction of the first 5 minutes. Shorted 2039.25 and filled for a point shortly after.

Saturday, April 9, 2016

Mother told me there would be days like this 4/8/2016

-----------------------------------------------------------

I have way too many days like this. If I can not turn these types of days around - I will never get the chance to be a full time trader. Here below is a blow by blow recall of Fridays trading for me.

------------------------------------------------------------

1) Market broke back into the morning range. Sold the pullback to 2048 but instead of going for one point, I wanted two - got a tick instead.

2) Tried reselling when the market paused at 2049.00. Too slow to get the fill at 2048.75.

3) Tried reselling again at 2049.75. Had my order in ahead of time but market did not tick there.

Between 3 and 4) - getting frustrated. Market looks like it is getting bought.

4) Saw huge offers at 2049.75 and 2050.00. Really stupid - my trading plan does not allow for this type of trade in a non-trending day. Got filled and stopped quickly. Thestop point is where I should be buying instead.

5) Again breaking the rules playing a type of breakout trade. Should have bought the pullback instead for a perfect trade. After 7 minutes, made a tick.

6) Frustrated enough to play a video game expecting the market to do nothing. Instead - it triggers a 50% of days range trade that I miss. Again the entry would have been perfect.

7) Had order in to short at 2051.75. Market ticks there but do not get filled. Market quickly moves 1 1/2 points away from my order so I pulled it. Should have left it in.

8) Tried shorting market on the close of the previous bar at 2049.75. Seconds late on what would be a perfect entry.

9) Shorted pull back to 2049.75. Trade went against me for one point where by my rules, I should have added to the position. I chickened out and do not add. To add insult to injury, I try moving buy stop lower thinking I could get at least 2 or more points, but the market takes me out.

10) Market breaks down pullbacks to last support point but my other half is yelling it is time to go to work. I saw f-it and shut down. Again another perfect entry.

-------------------------------------------------------------

Net results of the day : minus $40.

-------------------------------------------------------------

What I should have had if I followed my rules and was about 5 seconds faster on few of my trades: plus $460

Sunday, April 3, 2016

perfect ES trade 4/1/2016

On Friday - they tried to take them lower but couldn't. The they tried to take them higher, and I bought at support. Perfect trade, executed perfectly. My only regret was that the train left the station so fast and just kept going, I could not find a good entry point to get back in. It is fun when trading is this easy and thats no joke.

Saturday, April 2, 2016

A messy ES trade in amessy market 3/31/2016

This was a sideways market and i was playing it more like a semi-trending market. Either you buy the pullback of the breakout - first trade marked on the chart and/or you buy the pullback to the second entry point then add more contracts in the third trade entry stop.

-------------------------------

I bought in between the first and the second entry points and made a mess of things. I could have added at the lower level and saved the trade, but I didn't.

-------------------------------

One of my big mistakes I make too often is missing the first couple of trades either with no fills or putting in orders too late (see the short and long of the first two circles), then I am not in mental shape to trade the next trade. In other words, MISSED, MISSED, CHASE - get hit.

Getting in late ES trade 3/30/2016

I missed the first pulback to the correct buy level after the bulls got back into control. The market was a bit choppy. After the market made a new high, I should have bought around 2056.25 at first support, and then added at 2055.25. Instead I bought at 2056.00, did not add and then wrongly gave up on the trade after it exploded at 2:30 pm. If I had added at 20552.5, i would have taken it off at a gain of a point and then tried to allow the 2056.25 entry to become a runner-maybe get more then a point.

--------------------

All of this would have been mentally easier for me if I had made the first trade and then entered at the correct levels on the second trade according to my trading plan. Bad mental mistake.

--------------------

There are even third and forth trades marked by the green arrows later.

Friday, March 25, 2016

Perfect ES Trade 3/24/2016

This is how I trade now of days. Most of my trades are in the ES mini. Most of them are a goal of one point with a stop loss of 2 points. I attempt to have runners when I can.

===================================

The above trade was perfect. Market was in a range and I tend to get chopped while in it.

So wait for the range to be broken with the buyers in control (using stoc above 50%).

Buy the pullback - a pullback of 38 to 50% of last move.

Wait for target to be hit.

This time because of the choppiness, I did not try for a runner when I could have gotten 3 pts out of the trade.

===================================

Bottom line - perfect trade.

Subscribe to:

Comments (Atom)